CBSA Assessment and Revenue Management (CARM) Program

Registration is mandatory.

What changes next?

Effective January 1, 2026

A customs broker’s business number (BN) can no longer be used to release or account for commercial goods with the CBSA on an importer’s behalf. Importers must take the required steps now to ensure shipments can be customs‑cleared, and to avoid Late Accounting Penalties (LAPs) or shipments being returned.

Effective January 31, 2026

The CARM transition measure for waiving late payment penalties and interest will end. Overdue balances on the January 2026 Statement of Account (SOA) will be subject to late payment penalties, and accrued interest will be reflected on the February 2026 SOA.

IMPORTANT UPDATES

Effective January 31, 2026

The CARM transition measure for waiving late payment penalties and interest will end. Overdue balances on the January 2026 Statement of Account (SOA) will be subject to late payment penalties, and accrued interest will be reflected on the February 2026 SOA. See Customs Notice 25‑02

Effective January 1, 2026

A customs broker’s business number (BN) can no longer be used to release or account for commercial goods with the CBSA on an importer’s behalf. Importers must take the required steps now to ensure shipments can be customs‑cleared, and to avoid Late Accounting Penalties (LAPs) or shipments being returned. See Customs Notice 24‑27

Take action now to help prevent delays!

CARM affects all commercial goods entering Canada.

What is CARM?

The Canada Border Services Agency (CBSA) Assessment and Revenue Management (CARM) Program has transformed how the CBSA manages the import of commercial goods into Canada, including the requirement for importers to create a CARM Client Portal (CCP) account.

Who is affected?

Businesses importing commercial goods into Canada. Whether you’re a small business or large corporation, importing a little or a lot, CARM impacts you.

When is CARM Release 3?

CARM has been in effect since October 2024, so it’s imperative to take the necessary steps now to ensure your FedEx shipments will not be delayed at the border and to avoid potential monetary penalties.

Understanding CARM: A guide for commercial importers

Here are some of the key points for both resident and non-resident importers.

If you’re a commercial importer (i.e., import commercial goods into Canada), you need to obtain a valid Canadian Business Number and Import-Export program account (RM), as well as comply with all CARM requirements.

What are commercial goods? These are goods imported for sale or for business, industrial, commercial, occupational, or other similar uses. Casual/non-commercial goods (i.e., for personal use/consumption) are considered commercial goods when they are released and accounted for with the CBSA, by or on behalf of a commercial entity as the importer of record (resident or non-resident).

Note: The importer of record is the party identified on the customs declaration, when imported goods are released and accounted for with Canada Customs. Commercial entities are identified by citing their Canadian Business Number (BN).

CCP Registration

Creating a CARM Client Portal (CCP) business account is required to import goods into Canada and enable businesses to transact directly with the CBSA. Learn more about CCP registration.

Delegation of Authority

Importers must grant approval to their third-party service providers (e.g., customs brokers like FedEx) to enable them to continue managing their commercial importation activities via the CCP. Learn more about delegation of authority.

Post financial security to obtain Release Prior to Payment (RPP)

Since May 20, 2025, all commercial importers must post their own financial security (e.g., surety bond or cash deposit) to enrol and benefit from the RPP program. This enables customs broker(s) to maintain the current process of obtaining the electronic release on their behalf. Learn more about posting financial security.

Payment of import duties and taxes with the CBSA

Importers who want to pay the CBSA directly must inform FedEx Express or FedEx Logistics beforehand. Learn more about payment of import duties and taxes.

Exceptions to CARM

Individuals who import casual/non-commercial goods (not for sale or for business, industrial, commercial, occupational, or other similar uses) as the importer of record, will not be subject to the aforementioned requirements.

Additional information

- Creating a CARM Client Portal (CCP) business account will be required to import goods into Canada and enable businesses to transact directly with the CBSA.

- A commercial importer must designate a Business Account Manager (BAM) from their company to create and manage their CCP business account.

- The BAM must create a user account and input the importer’s company information to complete the setup of a CCP business account.

- The BAM will be asked to provide import transaction information contained in the importer’s Daily Notices (DNs) and monthly Statement of Account (SOA).

- Once the CCP business account is set up, additional BAMs can be designated to assist in the management of the account.

The New Commercial Accounting Declaration (CAD)

The Commercial Accounting Declaration (CAD) is the new digital document for accounting imported goods with the CBSA, including subsequent corrections or adjustments:

- No impact to customs clearance.

- Replaces the previous B3: Canada Custom Coding Form and the B2: Canada Customs – Adjustment Request.

- Serves as a single accounting declaration record for imported goods, with corrections and adjustments processed as subsequent versions of the original CAD.

- Available for importers to view, edit, or download in their CARM Client Portal (CCP) account.

- For details, please see CBSA Memorandum D17-1-5: Accounting for Commercial Goods.

For FedEx Express customers only:

- All FedEx invoices, activity records, and reports now reference the new CAD format and details.

- Please refer to your FedEx invoice or activity record for any Courier Low Value Shipment (CLVS) transactional details that are missing from your CAD.

- The importer’s BAM can grant this authorization to their third-party service providers (e.g., customs brokers) to enable them to manage their commercial importation activities via the CCP.

- Multiple customs brokers can be delegated to manage an importer’s commercial import activities. Importers must delegate each broker separately by logging into their CCP account and accepting the notification they receive from each one, to accept their business relationship.

- Only an importer’s delegated customs broker(s) will be able to perform customs entry filing and duty and tax assessment services on their behalf.

- The Delegation of Authority is an additional requirement and does not replace the current requirement for a General Agency Agreement (GAA)/ Power of Attorney (POA) to act on an importer’s behalf.

As of May 20, 2025, a customs broker’s RPP financial security no longer covers commercial importers.

To prevent clearance delays commercial importers must post their own financial security by enrolling in the RPP program via the CARM Client Portal (CCP). The RPP program allows for the electronic release of imported goods before payment of duties and taxes. For details, see Customs Notice 25-22.

Commercial importers are responsible for completing this requirement and can use the following options:

- Cash deposit: Follow the steps in the CARM Client Portal User Guide: Post financial security for Release Prior to Payment privileges to make a cash deposit directly through the CCP via credit or debit card and/or enrol in the RPP program once your payment has been submitted. You can pay using online banking through your financial institution. See the CBSA’s Commercial payments and accounts: Payments page on the Government of Canada website for details. Need help? See the CBSA’s Common Release Prior to Payment and Financial Security Challenges with Resolution Steps information sheet.

- Post a surety bond: Email CARM@fedex.com for assistance in posting a surety bond through a security provider. For more information, see CBSA Memorandum D17-5-2.

FedEx customers only: Once you have obtained financial security, email CARM@fedex.com so we can update our records.

Alternative: Self-Clearance (if you don’t post financial security)

- Submit a ‘Type C’ Commercial Accounting Declaration (CAD) via the CARM Client Portal (CCP).

- Visit a local CBSA office in person with the CAD(s) and any supporting documentation.

- Pay any applicable import duties and taxes owing directly to the CBSA before your shipment can be released.

See our FedEx Express Self-Clearance Guide for full instructions.

With the implementation of CARM Release 3, a customs broker’s RPP financial security no longer covers commercial importers. Beginning May 20, 2025 at 3 a.m. (EDT), all commercial importers must post their own financial security, such as a surety bond or cash deposit, to enrol and benefit from the Release Prior to Payment (RPP) program.

Note: The RPP program allows for the electronic release of imported goods before payment of duties and taxes.

To avoid clearance delays, all commercial importers should secure their financial security before the transition period ends. FedEx Express can assist importers to post a CARM bond. For more information, please email us at CARM@fedex.com. Alternatively, importers may work with security providers to post financial security. For a list of accepted providers, please see Appendix A of CBSA Memorandum D17-5-2.

The CARM Client Portal offers direct payment of import duties and taxes to the CBSA:

- As a FedEx Express customer, if you want to pay the CBSA directly, please notify us in advance by completing and submitting this agreement by email. For assistance, email CARM@fedex.com. To avoid duplicate charges, it’s important to advise us if you would like to pay the CBSA directly.

- If you do not notify FedEx Express about your preference to pay the CBSA directly, we will continue to handle the payment for any duties and taxes calculated for the goods we import on your behalf and invoice you accordingly.

If you’re a new commercial importer or a shipper looking to become a non-resident importer (NRI) for goods imported into Canada, you’ll need a valid BN and Import-Export program account (RM) number. For more information, please see the CBSA’s Step-by-Step Guide to Importing.

Commercial resident importers must now apply for their BN and RM through the CARM Client Portal (CCP). Non-resident importers are also required to apply for their RM through the CCP but must continue to use the CRA’s BN number registration process to obtain a BN.

The CBSA requires importers to retain all records of their imports into Canada for six years following importation. These records must be kept in Canada, the US, or Mexico; non-resident importers who do not have a place of business in Canada can designate an authorized agent, including cloud service providers. Non-compliance may result in monetary penalties. For more information, please see the CBSA website.

Download important CARM resources

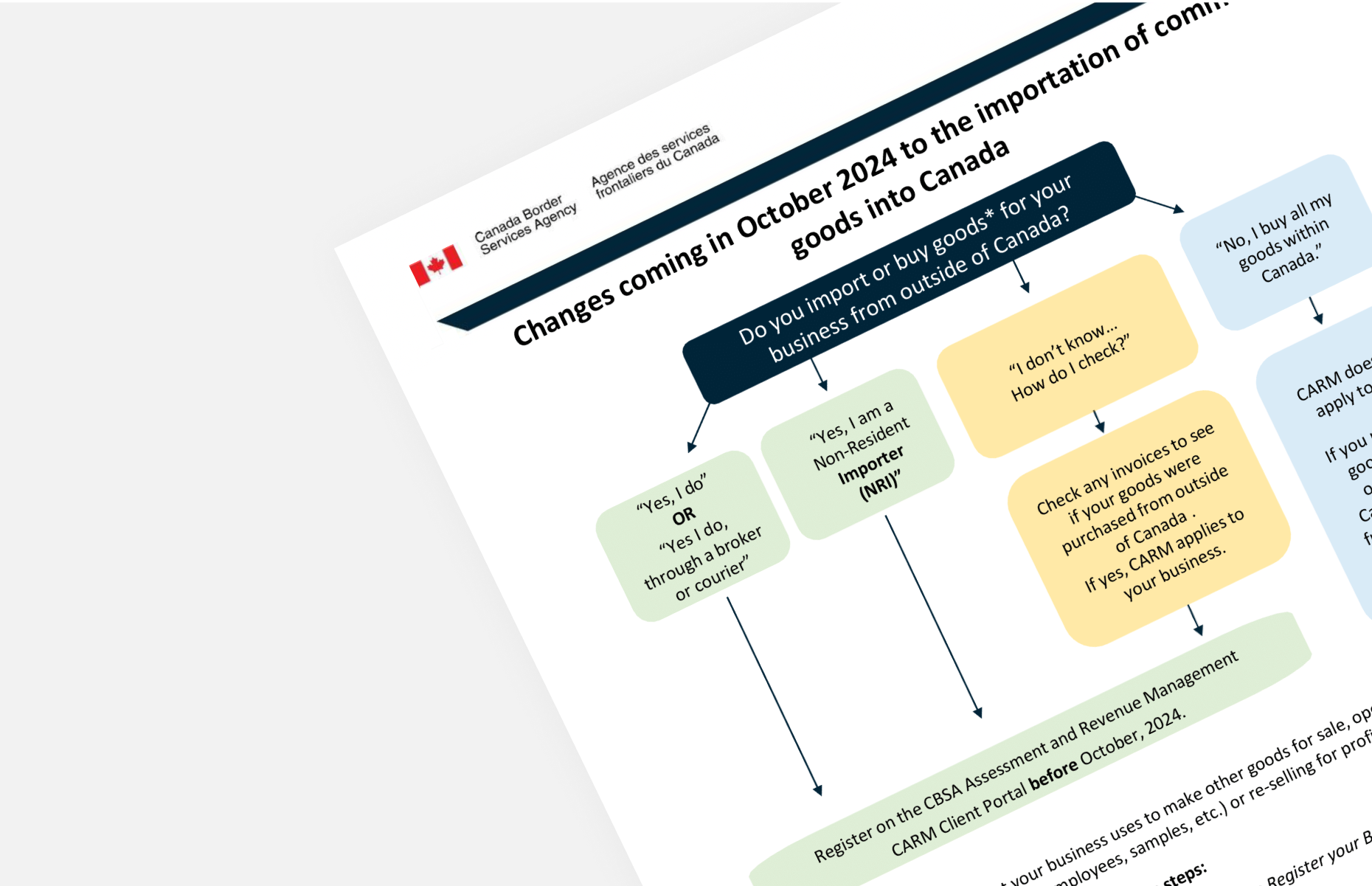

FedEx Express CARM Infographic

Explore our infographic that provides step-by-step guidance for navigating CARM.

CBSA CARM Onboarding Toolkit

Access a 3-page document featuring a user-friendly flowchart to help you with the CARM process.

Release dates & features

Get help with CARM

Visit Frequently Asked Questions

If you are a FedEx Express or FedEx Logistics customer, you can review the FAQs to find answers to many CARM-related questions.

Talk to a FedEx Expert

Whether you are a FedEx Express or FedEx Logistics customer, you can reach out to a specialist about your CARM-related questions.

Contact the CBSA

For questions about CARM and for assistance in complying with CARM requirements, please contact the CBSA through the form or call 1.800.461.9999.